As the cryptocurrency market grows rapidly, interest in DeFi (decentralized finance), which refers to a decentralized financial market, is also increasing. DeFi is an ecosystem where people can use cryptocurrency to use various financial services, such as transferring cryptocurrency, lending, and signing up for insurance, without financial institutions such as banks or securities companies. While the current financial market is one where financial services have developed based on fiat currency, DeFi refers to financial services formed based on cryptocurrency.

However, when the reporter directly used DeFi, the results were dismal. Because the fees were high, it was inefficient to make investments with small amounts of money. It was difficult to find reliable information, and the risk of losing all your cryptocurrency forever with a single click was lurking everywhere. This is why it is pointed out that it will be difficult for DeFi to become popular unless safety and reliability are improved.

The DeFi project that the reporter attempted with 200,000 won was ‘Lido.’ Lido is a project that returns 3 to 5% of the deposited Ethereum to Ethereum as a reward when you deposit (stake) Ethereum. The deposited Ethereum is used for ‘blockchain network verification’. In return for lending my Ethereum, I receive a profit in the form of interest. The structure is similar to when you deposit money into a bank account, and the bank makes a profit from this money and returns a portion of the profit as interest. According to DeFi analysis site DeFiRama, the amount of cryptocurrency deposited in Lido was $28.2 billion (approximately 38.978 trillion won) as of April 18, ranking first among DeFi projects.

|

| The homepage screen of Lido, the largest DeFi project in terms of total deposit amount (TVL). photo lido |

Saving fees is important

To deposit, purchase Ethereum from domestic cryptocurrency exchanges such as Upbit and Bithumb and transfer it to the cryptocurrency wallet presented by Lido. Just like depositing cash into a bank account, you transfer your Ethereum to your wallet. However, in Korea, you cannot use Lido directly. The only way to transfer Ethereum is in the following order: domestic exchange → overseas exchange → personal wallet → Lido wallet.

The problem is that a fee is incurred every time Ethereum is transferred. To transfer Ethereum based on Upbit, you must pay a fee of 0.01 Ethereum (about 48,000 won). This means that 20% of the principal (200,000 won) is taken out as fees. The key to cryptocurrency investment is how much you can save on fees rather than which DeFi provides the highest returns.

To minimize fees, we decided to use ‘Ripple’, another cryptocurrency. Ripple's transfer fee is 1 ripple (about 850 won), which is cheaper than Ethereum. The method is to purchase 200,000 won worth of Ripple from a domestic exchange, send it to Binance, an overseas cryptocurrency exchange, exchange (swap) it for Ethereum, and then send it back to a personal wallet and deposit it in Lido.

|

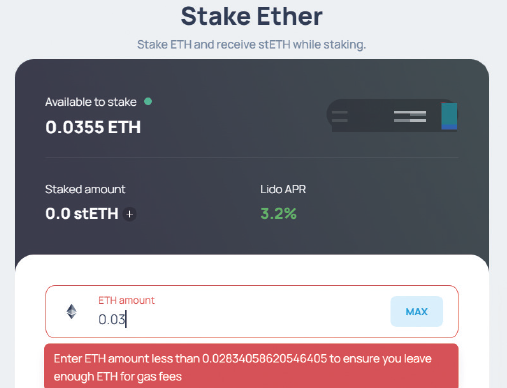

| A screen to determine the amount of Ethereum to be deposited in LIDO. The reporter holds 0.0355 Ethereum, but since a gasfee must be paid, the maximum depositable Ethereum is displayed as 0.028. photo lido |

The total commission incurred in this process was 0.006 Ethereum (about 28,000 won) and 1 Ripple. The fee was as much as 14% of the principal. As of April 3, when Ethereum was deposited in Lido, Lido’s reward rate of return was 3.13%. You need to receive rewards more than 10 times to cover the fees paid. The fee became expensive or cheap in a matter of seconds depending on the network conditions at the time of deposit, making it impossible to determine whether the fee paid was reasonable.

Two weeks have passed since the deposit, but the cryptocurrency investment came to an end with only a 3% loss. In exchange for the deposit, Ethereum in the name of interest was returned, but as the price of Ethereum fell in the meantime, the overall rate of return was negative.

According to CoinMarketCap, a global coin market relay site, the price of Ethereum fell from $3,300 (about 4.56 million won) on April 3, when the reporter completed the deposit, to $3,000 (about 4.14 million won) on April 18.

All financial accidents are the responsibility of the customer

A bigger problem than the rate of return when using DeFi is safety. DeFi does not have a controlling body like a bank. Customers are responsible for all financial accidents, including erroneous transfers of money to the wrong bank account. In the process of transferring cryptocurrency, if you enter the wallet address, which consists of upper and lower case letters and 42 numbers, incorrectly, you will never be able to find the deposited cryptocurrency.

Metamask, which creates cryptocurrency wallets, presented a 'secret recovery phrase' consisting of 12 English words similar to a public certificate to the reporter who created the wallet. Metamask warned that if there is a problem with the wallet account, without this phrase, the wallet where the cryptocurrency is stored will never be found. They emphasized several times that they cannot solve this problem. At the same time, it was recommended that this phrase be engraved on a stone tablet and safely stored in kind. It is less efficient than the traditional financial market, where public certificates can be reissued at any time. It was a moment when I questioned whether DeFi was really the future of finance.

There are 3,617 DeFi projects, but the ones that can be trusted and utilized are limited. Among the projects, 1,979 have a total deposit amount (TVL) of less than $10,000, and there are 688 projects with a total deposit amount (TVL) of $0. In particular, it is still vulnerable to attacks such as hacking and rug pull. Euler Finance, which previously provided a collateral loan service for depositing Ethereum and borrowing coins and tokens, suffered a hacking attack in March 2023 and suffered damage of $197 million (about 272.2 billion won). Due to this effect, the token price plummeted from $6 to $2, and the incident ended with only $110 million (approximately 152 billion won), about half of the damage, returned.

Kim Ji-hye, head of Xangle Research Center, said, “The reason why the size of DeFi deposits does not reach that level despite the Bitcoin price breaking its previous high is that you need to have a cryptocurrency-specific wallet like Metamask, and most services are in English, so general investors can use them. “This is because it is difficult to do,” he said. “DeFi, which requires you to directly manage your ‘private key’ and pay a fee, needs to overcome structural risks and improve user experience (UX), so there is still a long way to go.”

No comments:

Post a Comment