“When I tell investors that artificial intelligence (AI) beat the market by an average of 2 percentage points, they don’t really feel it. Rather, they are very surprised when they say, ‘A short-term AI model that buys and sells 300 times a day makes money even when the market falls by 2%.’ “Even investors who thought they were confident in short-term investment say they are finally feeling the power of AI.”

Stock investment, especially short-term buying and selling of stocks, has been recognized as an area where humans can generate higher profits than AI. Unlike long-term investment, information such as price and flow is important in short-term investment, but there is a perception that price, etc. are unsuitable as a learning target for AI. However, AI is also showing off in short-term hits. Korean company Craft Technologies (hereinafter referred to as Craft) is pioneering this area.

|

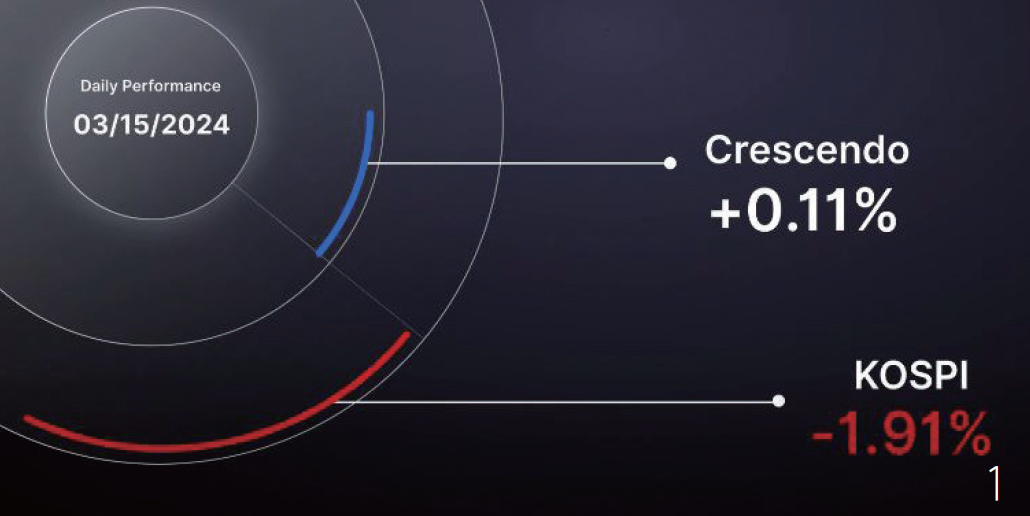

| 1 ‘Crescendo’, a short-term price prediction model developed by Craft Technologies. Even on March 15, when the KOSPI index fell -1.91%, Crescendo recorded a return of 0.11%. Photo: Craft Technology Logis |

Kraft's recently developed short-term price prediction model 'Crescendo' targets an expected return of 0.10% in daily trading, including achieving positive returns for 28 out of 30 days in the Korean stock market. In fact, even on March 15, when the KOSPI index fell -1.91%, Crescendo recorded a return of 0.11%.

Craft CEO Kim Hyeong-sik said, “It was only a few years ago that I thought that Baduk was a field where AI could not beat humans because it was so complex and required insight. “But now I know that even baduk was ultimately a kind of calculation,” he said. “I think trading is also a human domain now, but you will soon realize that if you have data, you can make profits every day.”

Kraft is focusing on developing technology that uses AI to analyze vast amounts of financial data and identify investment opportunities and patterns. What is noteworthy is that the AI Exchange Traded Fund (ETF) has been listed on the New York Stock Exchange since 2019. In November last year, LQAI (LG Qraft AI-Powered US Large-cap Core ETF), an ETF in collaboration with LG AI Research Institute, was listed on the U.S. stock market. I recently met CEO Kim at Craft headquarters in Yeongdeungpo-gu, Seoul. CEO Kim, who founded Craft in 2016, is a 'geek' who graduated from Seoul Science High School and Seoul National University's Department of Electrical Engineering. He began his path to entrepreneurship while developing a quantitative model algorithmic trading program for stock investment during his master's degree in economics at Seoul National University. The following is a Q&A.

|

| 2 (From left) FSITC Investment Trust Chairman Paul Yu, Softbank Executive Director Yuichiro Shinozaki, and Kraft Technologies CEO Kim Hyung-sik are announcing cooperation in developing AI-based financial investment technology. Photo FSITC Investment Trust |

How does AI hit a single hit?

“You can think of it as being similar to a trader at a securities company. This is a method in which AI determines the stock price fluctuations of stocks that need to be traded in the market at any time and places an order when it determines that the price is optimal. Craft has over 1,000 AI models. Models that make short-term predictions, such as seconds or minutes ahead, trade 200 to 300 times a day. This short-term model has good predictive power, but its operational CAPA is small. So, it is operated directly by Craft. There is no method available to individual investors. “Monthly and yearly forecast models have large capacity, so they are made public or supplied to financial companies to create and sell financial products such as ETFs.”

Can AI really beat humans?

“While humans tend not to change their existing thoughts once they have decided, AI does not hesitate to buy or sell when an abnormal signal occurs. It can create an infinite number of products that suit investment tendencies, and can also play a role in reducing the information gap between institutional and individual investors. In addition, AI has recently developed interpretation skills like humans. Among the research data released by S&P Dow Jones Indexes, the 'SPIVA Report Card', which evaluates whether fund managers are actually generating excess returns compared to the benchmark, shows that fund managers that have been generating excess returns compared to the benchmark for five years are at the level of 13%. It's just that. “I think the Craft AI model has caught up to this level.”

|

| 3 Kim Hyeong-sik (front row, center), CEO of Kraft Technologies, participated in the New York Stock Exchange ETF listing ceremony in May 2019. Photo Craft Technologies |

We also developed an ETF with LG.

“The capital market prediction and investment portfolio construction model developed by LG AI Research Institute has been integrated into Kraft’s AI ETF operation process. I find it really fascinating to be overseas. This is because LG is famous for home appliances, so it is difficult to think of it as an AI company. They said it felt as if Miele, a German company famous for washing machines, had launched an ETF. So it received a lot of attention.

However, as it turns out, LG is investing a lot in AI. Since we are in the battery business, raw material prices are important, so we have already been using AI to predict lithium prices. LG AI Research Institute's investment portfolio construction AI model ranked 4th in the rate of return category in the 'M6' competition, the world's largest time series forecasting competition. We ended up collaborating because that part was similar to predicting stock prices. The results are not bad either.

“It’s been about 5 months since the ETF was listed, and the rate of return fluctuates around 20%.”

You have listed an ETF on the US market. How long do you think the bull market will continue?

“Personally, I think it’s an upward trend. Of course, there will be an adjustment, but I think it will go up from a long-term perspective. This is a big difference from Korea, as the U.S. structure has a well-designed stock-based economic system, and incentives for each entity are designed to increase stock prices. “If you look at it that way, I think it would be a good idea to adopt a beta investment strategy that follows the market rate of return based on the efficient market hypothesis.”

Can AI predict Bitcoin signals?

“I think short-term predictions are ultimately possible. In a perfectly efficient market, prediction is impossible. However, if you look at the Bitcoin market participants, there are basically more investments for speculative purposes than the stock market. There are many people who act irrationally. The market size is not large and there are many sudden rises and falls. “It is a highly volatile market (although it is more difficult than the stock market), so I think it is possible to make predictions if you approach it by analyzing the data well.”

There is a lot of talk that the price will rise further when the halving occurs, when Bitcoin mining volume is reduced by half.

“The half-life is too big a signal, but there are only four so it doesn’t have much statistical value. Of course, if the price of Bitcoin has risen during all four halvings, you can think that it could rise for the fifth time as well. However, considering that the halving logic is that supply decreases and the price increases, it is questionable how much of an impact it will have in a situation where a lot of Bitcoin has already been released.”

What will future asset management look like?

“I think AI has almost completely encroached on the trading field, and it seems like that has already happened. Wouldn't people become more free from analyzing numbers and instead start thinking more in the humanities? “Until now, AI focused on data calculations and still required humans to extract insights from this data, but now even that is becoming automated.”

So what strategy should investors develop?

“It is important to find a good company not only in Korea but also around the world. In any case, frequent trading or short-term trading is likely to become increasingly difficult. Then, people need to find something they can do well. From a long-term perspective, it is insight into how the industrial structure will change and which companies will grow. “This is something AI can never have.”

No comments:

Post a Comment